As digital banking technology has advanced, transmitting payment online - not offline - has become the industry standard. However, just because you no longer write a physical check does not mean the information contained on the check has changed. In this section, we'll explain how to locate your routing and account numbers as an Amplify Credit Union customer. We'll also provide you with some helpful resources should you need assistance from an Amplify Credit Union customer service representative.

Key Takeaways:

- The routing number for Amplify Credit Union is 314977227. This routing number is the same for electronic (ACH) transfers and wire transfers.

- Your Amplify account number(s) can be found on your checks or in online banking.

- Amplify does not use an IBAN or SWIFT code.

What are routing numbers?

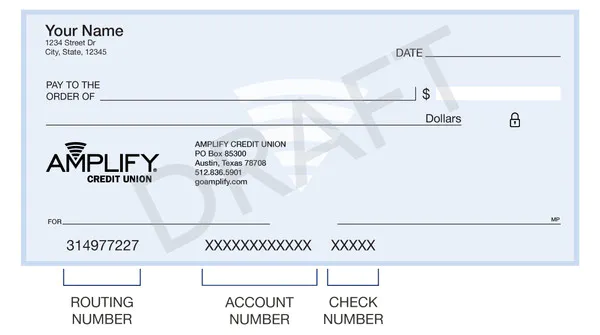

Like all financial institutions, Amplify Credit Union relies on its routing number to track the thousands of transfers, direct deposits, and automatic payments that occur every day. Routing numbers - also known as an American Bankers Association (ABA) number or a routing transit number - are nine-digit codes located on the bottom of your check. This number serves as a unique identifier to help other banks and businesses to find your account.

What are account numbers?

Your account number is the number that uniquely identifies each of your accounts. When taken together, your routing number and your account number allow other parties - such as lenders, credit card companies, or even friends and family members - to transfer money directly between accounts.

What is my Amplify Credit Union routing number?

Amplify's routing number is 314977227. This number can be used for all Automated Clearing House (ACH) activity and wire transfers. You can also locate this number on the bottom left-hand corner of your checks.

What is my Amplify account number?

Unlike routing numbers, account numbers are unique to each checking or savings account. Each account you open with Amplify Credit Union - be it a checking account, savings account, or an existing loan - will have an associated account number. You can identify your account number in one of three ways:

- Locate Your Account Number on Your Check. Your 10-12 digit account number will immediately follow the routing number on the bottom-lefthand side of your checks. Please note: if your checks were not issued within the last six months, you may want to confirm those numbers using the alternate methods listed below.

- Log Into Online Banking. Members who have enrolled in online banking can always view their account numbers in the online banking portal. Click the Profile & Settings dropdown in the online banking menu, then click Account Preferences. Here you will be able to view the account numbers for each active account.

- Call Customer Service. If neither of the above options is available to you, you can always call our customer service team at (512) 836-5901 or toll-free at (800) 237-5087. Please note that you will be asked a series of personal questions to identify your account.

When will I use my routing number and account number?

Unless you operate entirely in cash, your routing number and/or your account number will be used to connect your existing accounts to external sources. Here are just a few of the ways you may use these numbers as part of your daily money management routine:

- Connect your Amplify Credit Union accounts to peer-to-peer payment platforms.

- Schedule recurring payments for student loans, mortgages, and automobile payments.

- Schedule one-time or recurring payments to credit cards.

- Transfer money between friends or family members at Amplify Credit Union (account number only).

- Transfer money via a domestic wire transfer.

Does Amplify use IBAN or SWIFT codes?

IBAN and SWIFT codes help identify banks and accounts internationally. Amplify does not utilize either of these numbers. If a person or company is asking for the information to send you money, the sending bank must use their correspondent bank in the United States and provide Amplify’s ABA routing number to get the money to a Amplify account.