At Amplify, our biggest priority is the safety of our member deposits. And because businesses and nonprofits often require a level of support above and beyond the banking needs of consumers, we are excited to now offer excess share insurance to organizations in our community. In this article, we will explain how businesses can receive up to $250,000 in deposit insurance through the National Credit Union Administration, as well as an additional $250,000 in excess share insurance with a business money market account at Amplify.

Key Takeaways

- Business members are automatically insured for up to $250,000 through the National Credit Union Share Insurance Fund.

- Amplify also offers complimentary excess share insurance through our business money market accounts. This will increase the total insured amount an additional $250,000 for a total of $500,000 in share insurance.

- Excess share insurance is offered free of charge with our business money market accounts.

- To learn more, contact our treasury management team at treasurymanagement@goamplify.com.

What is the basic deposit insurance offered by Amplify?

Because Amplify is a federally insured credit union, business members are eligible to receive up to $250,000 in deposit insurance through the National Credit Union Share Insurance Fund (NCUSIF). You can learn more about deposit insurance – including the account categories and insurance limits – by visiting the National Credit Union Administration website.

What is excess share insurance?

For businesses that need to maintain a great degree of liquidity, Amplify also offers excess share insurance. This is a form of private insurance offered through the Excess Share Insurance Corporation (ESI) that increases the deposit insurance limits an additional $250,000 up to $500,000 for qualifying accounts.

About ESI

Headquartered in Dublin, Ohio, ESI is a wholly owned subsidiary of American Share Insurance, a credit union owned private deposit insurer founded in 1974 by credit unions, for credit unions. As a property and casualty insurer, ESI is subject to licensing and regulation by your state’s insurance department. Additional information can be found on their website ESI.

Who qualifies for excess share insurance?

Business members are eligible for excess share insurance based on their individual employer identification number (EIN) or tax ID. If your business is a sole proprietor, your total coverage will include your personal balances whether you use your social security numbers (SSN) or EIN.

Only funds in our business money market accounts are eligible for the additional coverage. Individual statements of coverage will not be provided.

Why is excess share insurance only offered on money market accounts?

Excess share insurance is a special benefit designed to enhance the financial security of your business. Because Amplify pays all fees related to excess share insurance fees for qualified businesses, we also limit the eligible account types to ensure the long-term success of our program.

What is the cost of excess share insurance at Amplify?

There are no fees or additional costs related to excess share insurance on our money market accounts. This coverage is automatically included when opening a business money market account.

Will I be notified if I receive excess insurance coverage?

Excess insurance coverage is automatically included when opening and funding a business money market account. Individual statements will not be provided, and you will not be notified of qualified coverage.

What is the calculation for excess share insurance?

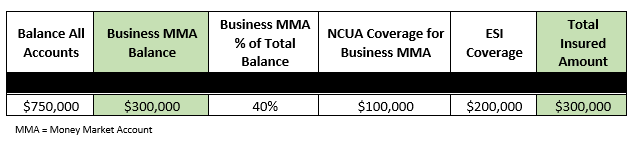

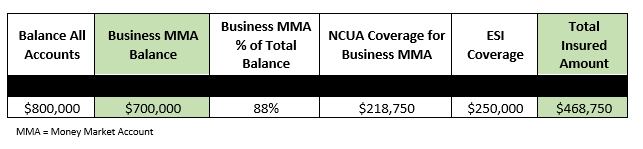

The instructions for how to calculate it manually are listed below.

- Total the amount of all deposit accounts under the EIN/Tax ID Number.

- Calculate the total amount in the business money market account.

- Divide the balance in the business money market account by the total of all deposits. This will provide you with the percent of total funds in your money market account.

- Multiply the percentage by $250,000. This is the amount of NCUA coverage.

- Subtract the number of the amount of NCUA coverage by the balance in the business money market account. This is the amount insured through ESI. The maximum amount is $250,000. Any excess funds will not be insured.

- Combine the NCUA deposit insurance and the ESI coverage to calculate the total insured amount. The amount should not exceed $500,000.

What if my expected balances are more than the combined coverage?

If you need additional support structuring your business accounts or have additional questions about excess deposit insurance at Amplify, please contact our team at treasurymanagement@goamplify.com or by phone at (512) 519-5479.